Theft of catalytic converters is a persistent and costly issue for businesses with commercial fleets. Many fleet operators turn to their insurance provider after they experience theft, only to discover that their coverage is not always guaranteed or comprehensive. You rely on your fleet to stay operational and profitable. The impact of catalytic converter theft can include vehicle downtime, missed deliveries, increased emissions liability, reputational damage, and repair costs. One stolen converter can stall an entire route, delay service, and erode customer trust.

Understanding how insurance treats catalytic converter theft is essential for risk management, avoiding unexpected costs, and maintaining operational continuity.

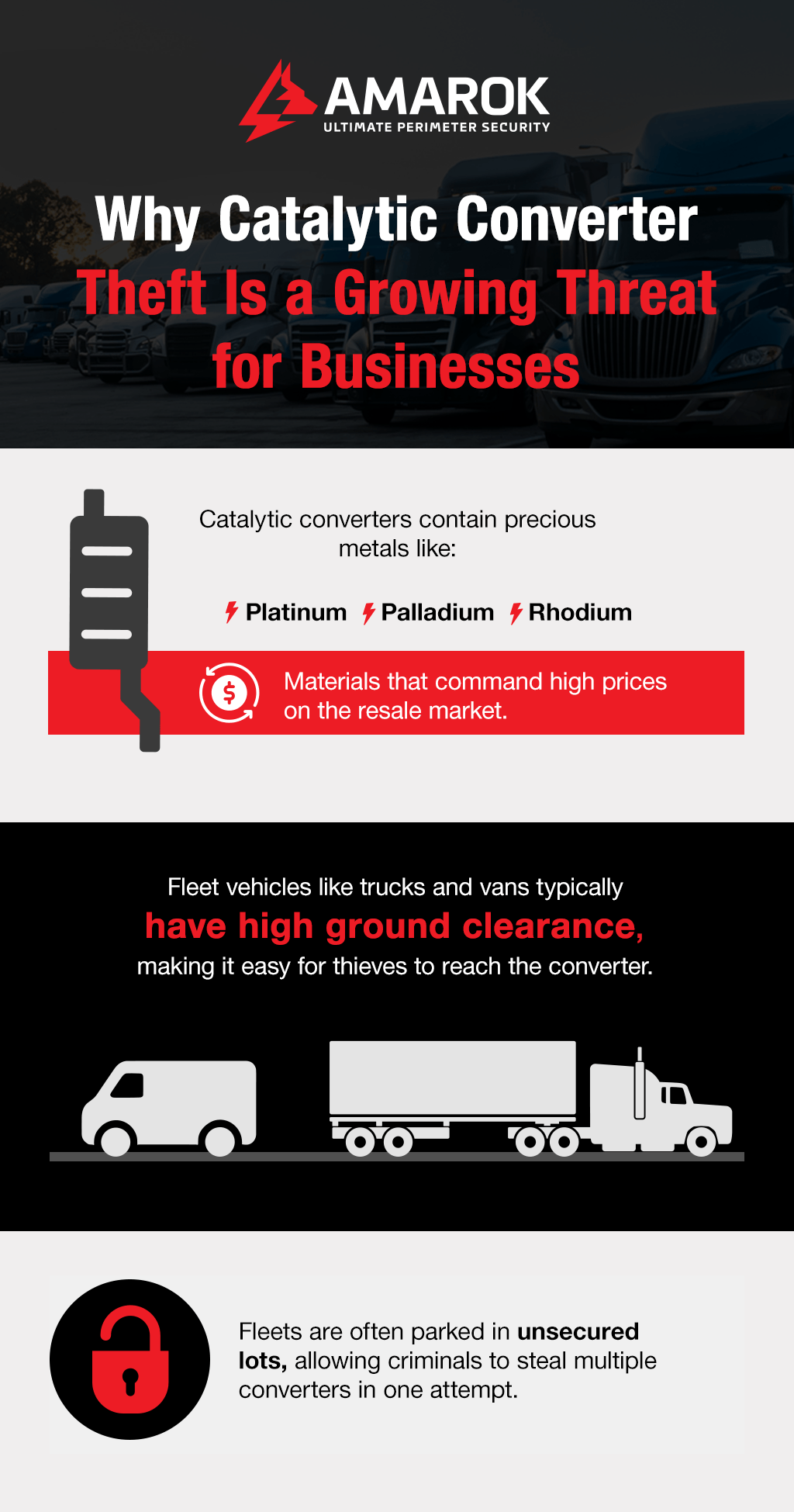

Why Catalytic Converter Theft Is a Growing Threat for Businesses

Catalytic converter theft affects heavy-duty delivery trucks and light-duty vehicles alike. According to the National Automobile Dealers Association, when thieves are interrupted, they can become violent, endangering employees and security personnel. In addition, catalytic converter theft costs fleet operations thousands in repairs yearly, and insurance claims add up to millions in related damage to property or vehicles.

Commercial fleets are a prime target for several reasons:

- Catalytic converters contain precious metals like platinum, palladium, and rhodium — materials that command high prices on the resale market. Rhodium alone can go for as high as $5,775 per ounce, and a stolen converter can net between $300 and $1,500. Replacing one catalytic converter costs vehicle owners over $2,500.

- Fleet vehicles like trucks and vans typically have high ground clearance, making it easy for thieves to reach the converter.

- Fleets are often parked in unsecured lots, allowing criminals to steal multiple converters in one attempt.

Does Insurance Cover Catalytic Converter Theft?

Yes, business insurance often covers catalytic converter theft, but typically only if you have comprehensive coverage. This type of coverage pays for damage not caused by a collision, including theft and vandalism. After you pay your deductible, your insurer covers the cost of replacing the catalytic converter and repairs to any other damage caused by the theft.

If your policy only includes liability or collision coverage, catalytic converter theft may not be covered. Liability coverage typically only handles injuries and damage you cause to others. Collision coverage typically only covers accidents. Neither usually protects against theft.

Why Catalytic Converter Theft Might Not Be Covered

In some cases, insurance may not cover catalytic converter theft. For example, waiting too long to file a report with the authorities or your insurance carrier can breach the policy’s reporting requirements. Additional reasons why this type of theft may not be covered are often buried in policy details or tied to risk assessments:

- Outdated policies: If your fleet has grown or changed and your policy wasn’t updated, newer vehicles may be uninsured.

- Unreported vehicle modifications: Modifying a vehicle’s exhaust system or removing emissions components without notifying your insurer can violate policy terms and void coverage, even if the modification wasn’t related to the converter.

- Policy exclusions for unattended vehicles: Some commercial insurance plans limit theft coverage if vehicles are left unattended in unsecured locations, especially overnight. Your claim may be denied if your fleet sits in an open lot without perimeter security measures.

- Failure to maintain reasonable security measures: If you’re repeatedly targeted and haven’t taken corrective action by implementing a physical security strategy, future claims may be limited or denied.

- Lack of monitoring: You may not be covered if you don’t have evidence of the incident, such as video footage or signs of forced entry, to send to your insurance provider.

- High-risk fleet classification: Fleets in areas with elevated theft rates or past theft claims may be put in high-risk categories. This categorization can lead to reduced coverage, theft-specific exclusions, or coverage denial.

- Use of aftermarket parts: Some policies require the use of original manufacturer parts to qualify for replacement coverage. If your fleet uses salvaged or non-OEM catalytic converters, you may be unable to file a claim for catalytic converter theft.

How to Protect Your Fleet

Relying solely on insurance to protect your fleet is a reactive strategy. A more proactive security solution is one that deters theft before it happens, saving you the cost, stress, and risk of filing claims. Secure your assets today with an integrated approach that includes the following layers:

- Electric fencing: An electric fence creates a formidable physical barrier around your property. It delivers a safe but memorable electric shock if any unauthorized personnel attempt to tamper with the fence. The Electric Guard Dog™ Fence features pulsed electricity every 1.3 seconds, which makes it safe.

- Alarm-based lighting: If the electric fence goes into alarm, the alarm-based lighting system is activated to flood the area with light, deterring would-be intruders and improving visibility for security cameras.

- Video surveillance: Video surveillance systems help protect your site by ensuring you can monitor as many angles along your perimeter as possible. Strategically placed cameras help you capture footage of any criminal activity, which can serve as compelling evidence in investigations.

- Remote and mobile monitoring: With remote and mobile monitoring for your security cameras, potential threats can be verified and responded to in real time. If there is an attempted breach, security personnel verify the event and can contact law enforcement or designated responders. Having recorded footage serves as dual verification and can expedite the response time in many jurisdictions requiring video proof before dispatching officers.

- Access control: Gate Access Control with automated gates and credential-based entry systems helps control who enters and leaves your premises. This solution tracks access history, reduces unauthorized entry, and provides a clear record for internal or external investigations.

Protect Your Fleet With Perimeter Security Solutions from AMAROK

You can hope that your commercial property insurance will bail you out in the event of catalytic converter theft — but too often, this leads to costly results. Safeguard your profits and your business assets with proactive security measures that protect your fleet 24/7. AMAROK is an industry-leading perimeter security solutions provider, helping customers save an average of $120,000 when they replace 24/7 security guards with our system. Consider the fact that 99% of our customers report no external theft after installation — something that will stand out with your insurance provider.

Speak with a security expert today or schedule a free threat assessment to get started with a custom strategy for your fleet.